What You Need to Know Before You Submit Your Online Tax Return in Australia

What You Need to Know Before You Submit Your Online Tax Return in Australia

Blog Article

Worry-free Tax Obligation Period: The Benefits of Declaring Your Online Income Tax Return in Australia

The tax period can typically feel frustrating, however filing your tax obligation return online in Australia provides a structured technique that can reduce a lot of that anxiety. With user-friendly systems given by the Australian Tax Office, taxpayers profit from features such as pre-filled info, which not only simplifies the procedure but additionally enhances precision.

Streamlined Filing Refine

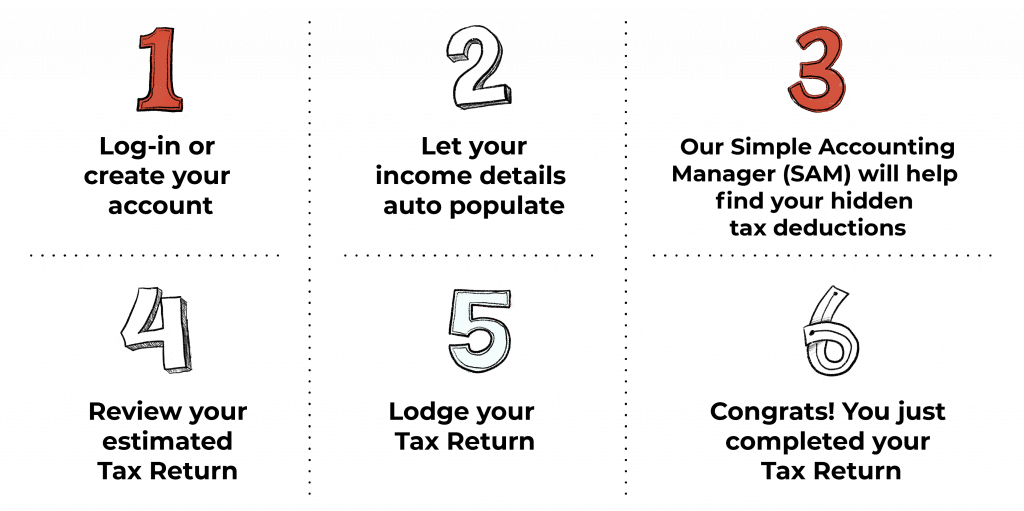

Many taxpayers often locate the on the internet income tax return process in Australia to be effective and simple. The Australian Tax Workplace (ATO) has created an user-friendly online platform that streamlines the declaring process. Taxpayers can access their accounts with the ATO internet site or mobile application, where they are directed step-by-step with the entry process.

By getting rid of several of the complexities connected with typical paper kinds, the on-line tax obligation return procedure not just improves clearness but also encourages taxpayers to take control of their economic coverage with confidence. This simplified filing procedure is a significant development, making tax period much less intimidating for Australians.

Time-Saving Advantages

The on-line income tax return process in Australia not only streamlines declaring but likewise provides significant time-saving benefits for taxpayers. Among the most notable advantages is the ability to finish the entire procedure from the convenience of one's home, getting rid of the requirement for in-person appointments with tax obligation experts. This convenience permits individuals to choose a time that matches their routines, leading to boosted effectiveness.

In addition, on the internet systems usually supply user-friendly interfaces and detailed assistance, which aid taxpayers navigate the intricacies of tax obligation declaring without comprehensive previous knowledge. The pre-filled info offered by the Australian Tax Workplace (ATO) further enhances the procedure, allowing individuals to rapidly validate and update their details instead than beginning from scratch.

One more benefit is the prompt access to resources and support via online help areas and discussion forums, enabling taxpayers to fix questions immediately. The ability to save development and go back to the return any time additionally adds to time efficiency, as users can handle their work according to their individual dedications. Overall, the on the internet tax return system dramatically lowers the time and effort required to fulfill tax obligation obligations, making it an attractive choice for Australian taxpayers.

Enhanced Precision

Boosted precision is a significant advantage of submitting tax obligation returns online in Australia (online tax return in Australia). The electronic systems used for on-line tax obligation entries are created with integrated checks and recognitions that lessen the danger of human error. Unlike conventional paper techniques, where manual calculations can lead to mistakes, on-line systems instantly execute calculations, making sure that figures are appropriate before entry

In addition, lots of on the internet tax solutions use attributes such as information import choices from prior income tax return and pre-filled info from the Australian Tax Office (ATO) This assimilation not only streamlines the procedure however also improves accuracy by reducing the demand for hands-on data access. Taxpayers can cross-check their info more successfully, considerably lowering the opportunities of errors that can cause tax liabilities or postponed refunds.

In addition, online tax obligation filing systems typically provide instantaneous feedback pertaining Continue to prospective discrepancies or noninclusions. This proactive strategy enables taxpayers to fix issues in actual time, guaranteeing conformity with Australian tax legislations. In recap, by choosing to submit online, individuals can gain from a more precise income tax return experience, eventually adding to a smoother and more effective tax obligation season.

Quicker Refunds

Submitting income tax return on the internet not just enhances precision yet also speeds up the reimbursement process for Australian taxpayers. One of the considerable benefits of electronic filing is the speed at which reimbursements are processed. When taxpayers send their returns online, the details is transmitted directly to the Australian Taxes Workplace (ATO), reducing delays related to documentation handling and manual processing.

Normally, on-line income tax return are refined faster than paper returns. online tax return in Australia. While paper submissions can take numerous weeks to be analyzed and completed, electronic filings usually result in refunds being issued within a matter of days. This effectiveness is especially useful for people who count on their tax obligation reimbursements for crucial expenditures or economic preparation

Eco-Friendly Alternative

Going with on the internet income tax return presents an environmentally friendly alternative to traditional paper-based declaring approaches. The shift to digital procedures dramatically lowers the reliance on paper, which subsequently reduces logging and lowers the carbon footprint connected with printing, shipping, and storing paper records. In Australia, where ecological issues are increasingly extremely important, embracing online tax obligation filing aligns with more comprehensive sustainability goals.

Moreover, digital submissions decrease waste produced from printed kinds and envelopes, adding to a cleaner atmosphere. Not just do taxpayers take advantage of a more efficient filing process, yet they additionally play an active duty in promoting eco-conscious techniques. The digital strategy enables prompt access to tax obligation files and records, getting rid of the requirement for physical storage remedies that can eat extra sources.

Final Thought

In conclusion, filing income tax return online in Australia presents countless advantages, including a structured process, substantial time savings, enhanced precision through pre-filled info, expedited reimbursements, and an environment-friendly strategy. These features jointly boost the overall experience for taxpayers, promoting an extra sustainable and reliable method of taking care of tax obligation obligations. As digital remedies remain to develop, the benefits of on-line declaring are most likely to come to be progressively noticable, more motivating taxpayers to embrace this modern method.

The tax obligation period can often feel overwhelming, however filing your tax return online in Australia uses a structured method that can minimize a lot of that stress and anxiety. Overall, the online tax return system considerably decreases the time and effort needed to satisfy tax responsibilities, making it an attractive option for Australian taxpayers.

Furthermore, numerous on the internet tax services provide online tax return in Australia functions such as data import options from prior tax obligation returns and pre-filled details from the Australian Taxes Workplace (ATO) In summary, by choosing to file online, people can profit from a much more precise tax return experience, ultimately contributing to a smoother and extra reliable tax obligation season.

Generally, online tax obligation returns are refined much more rapidly than paper returns.

Report this page